April Market Review

"When you quit, you live to fight another day. If we don't cut our losses when its warranted, those losses will continue to accumulate." Annie Duke, author of Thinking in Bets

Executive Summary

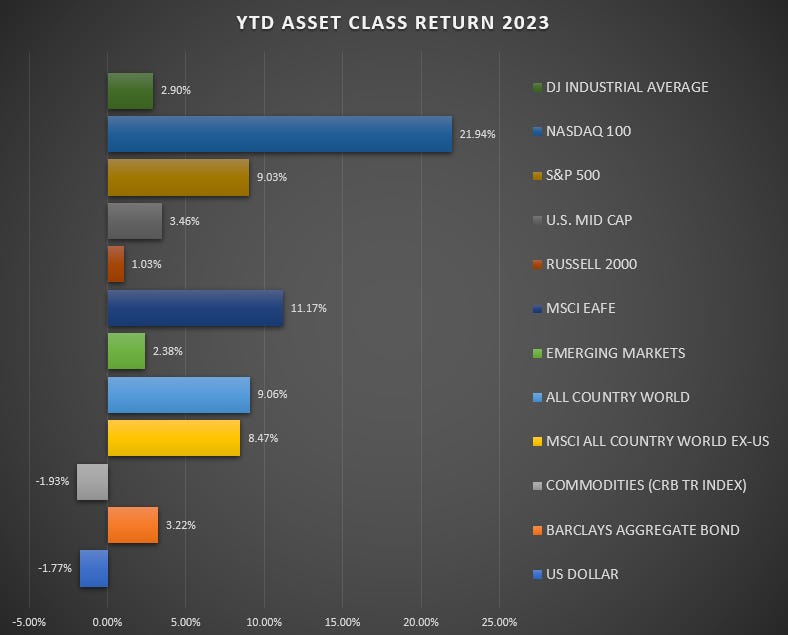

Global markets grind higher: Global markets demonstrated predominantly positive trends in April 2023, despite concerns about a banking crisis in the US, high inflation rates, and sluggish growth. International developed equities maintained their strong performance, with the Nasdaq 100 experiencing a temporary pause in April, following an impressive gain of over 20% in the first three months of the year.

Q1 earnings season: This season is seeing better results than analysts predicted. With 53% of S&P 500 companies reporting through 4/28, the actual results show a decline of only -3.7%, compared to the expected decline of -6.7%. It's worth noting that nine out of eleven sectors surpassed expectations.

First quarter economic growth slows: According to the initial estimate for Real Gross Domestic Product (GDP), the economy grew at an annualized rate of 1.1 percent. While initial predictions anticipated a growth rate of 1.9 percent, the consumer has demonstrated impressive resilience despite the weaker-than-expected results.

Home on the range: For almost a year, the S&P 500 has been stuck in a range, causing frustration for bulls and bears. Despite the Federal Reserve raising interest rates by 500 basis points, persistent inflation, slowing growth, earnings declines, and regional banking turbulence, the S&P 500 remains unchanged from a year ago.

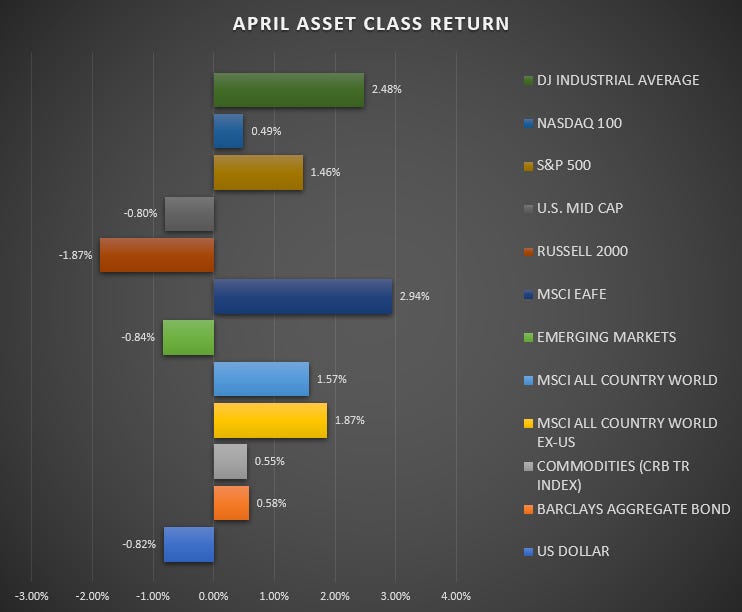

Global markets grind higher: In April 2023, the global markets showed mostly positive trends, which is great news despite the concerns about a banking crisis in the US, high inflation rates, and slow growth. International developed equities had a strong performance, with the Nasdaq 100 taking a brief pause in April, after an impressive gain of over 20% in the first three months of the year.

Over the past month, MSCI EAFE international equities displayed the strongest returns, boasting a gain of +2.94 percent. The Dow Jones Industrial Average also had a strong showing with a gain of +2.48 percent, while the S&P 500 increased by +1.46%, and the Nasdaq 100 advanced by +0.49%. US mid and small caps saw -0.87 and -1.87 percent declines, respectively, as worries about the fallout from the regional banking turmoil weighed on smaller companies.

Global equities posted gains of +1.57 percent, with global equities ex-US showing an impressive increase of +1.87 percent. In contrast, emerging markets experienced a decline of -0.87 percent.

The Barclays Aggregate Bond Index demonstrated a gain of +0.58 percent for the month, bringing year-to-date gains to +3.22 percent. Additionally, commodities increased by +0.58 percent, while the dollar declined by -0.82%.

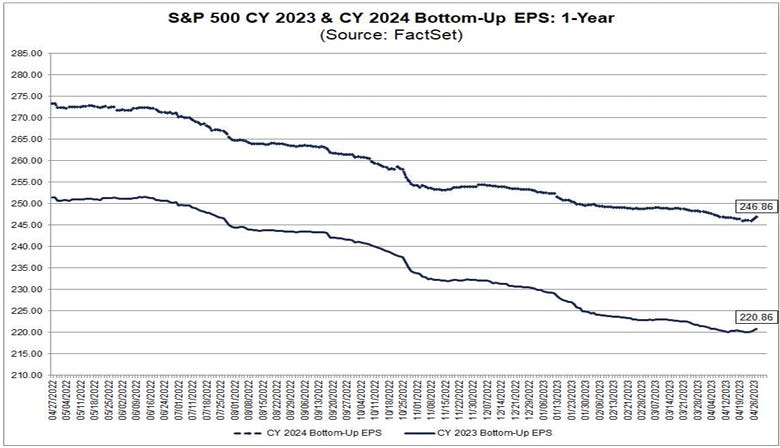

Q1 earnings season: This season is seeing better results than analysts predicted. With 53% of S&P 500 companies reporting through 4/28, the actual results show a decline of only -3.7%, compared to the expected decline of -6.7%. It's worth noting that nine out of eleven sectors surpassed expectations.

According to FactSet earnings analyst John Butters, as we’ve reached the halfway point in earnings season, the results have been impressive, given the collective worries of the analyst community. Here’s John:

At the mid-point of the Q1 2023 earnings season, S&P 500 companies are recording their best performance relative to analyst expectations since Q4 2021. Both the number of companies reporting positive EPS surprises and the magnitude of these earnings surprises are above their 10-year averages.

Out of all the companies that have shared their results, 79% reported actual EPS exceeding their estimates. This is better than the 5-year average of 77% and the 120-year average of 73%. Overall, companies are reporting earnings that are 6.9% higher than their estimates, which has helped support equity prices in general.

Regarding revenue, a majority of companies - 74 percent - have reported actual earnings that exceed initial estimates. This percentage is higher than the 5-year and 10-year averages of 69% and 63%, respectively.

Even more interesting is that these strong results have already started bleeding into analysts’ expectations for the balance of 2023 and 2024, as full-year estimates are being revised higher.

Although we are only a few weeks into earnings season, the initial results are promising. It’s still too early to draw any broad conclusions, but early indications suggest that the state of corporate America is not nearly as dire as some had feared. If we are going to see the collapse in earnings that many have predicted, at least up to this point, it hasn’t shown up in the data.

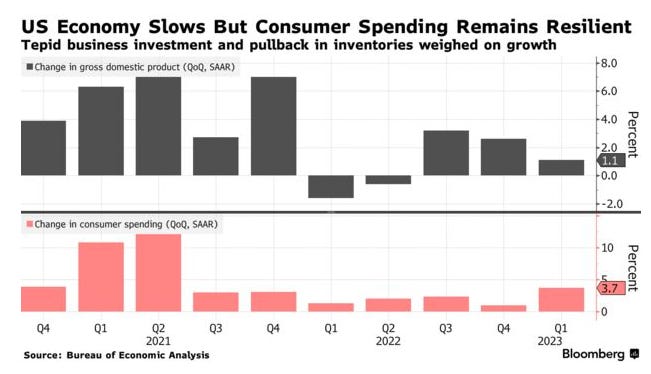

First-quarter economic growth slows: According to the initial estimate for Real Gross Domestic Product (GDP), the economy grew at an annualized rate of 1.1 percent. While initial predictions anticipated a growth rate of 1.9 percent, the consumer has demonstrated impressive resilience despite the weaker-than-expected results.

The biggest takeaway for the first quarter was the very obvious downshift in the growth of the economy, decelerating from 3.2 percent in Q3 ‘22 to 2.6 percent in Q4 and to Q1 ‘23 with a rate of 1.1 percent. Despite the slowing economy, the 3.7 percent increase in consumer spending is impressive. Spending on services grew at a 2.3 percent rate, led by healthcare, restaurants, and hotels. Spending on goods increased to 6.5 percent, the highest in nearly two years.

Business outlays for equipment posted the largest decline since the beginning of the pandemic, with a 7.3 percent annualized decline. Inventories subtracted the most from GDP in two years, taking over two percentage points off of GDP.

Despite missing headline estimates for growth, the underlying strength in consumer spending - bolstered by rising wages, falling inflation, and record-low unemployment - makes the argument for an immediate recession increasingly difficult to understand.

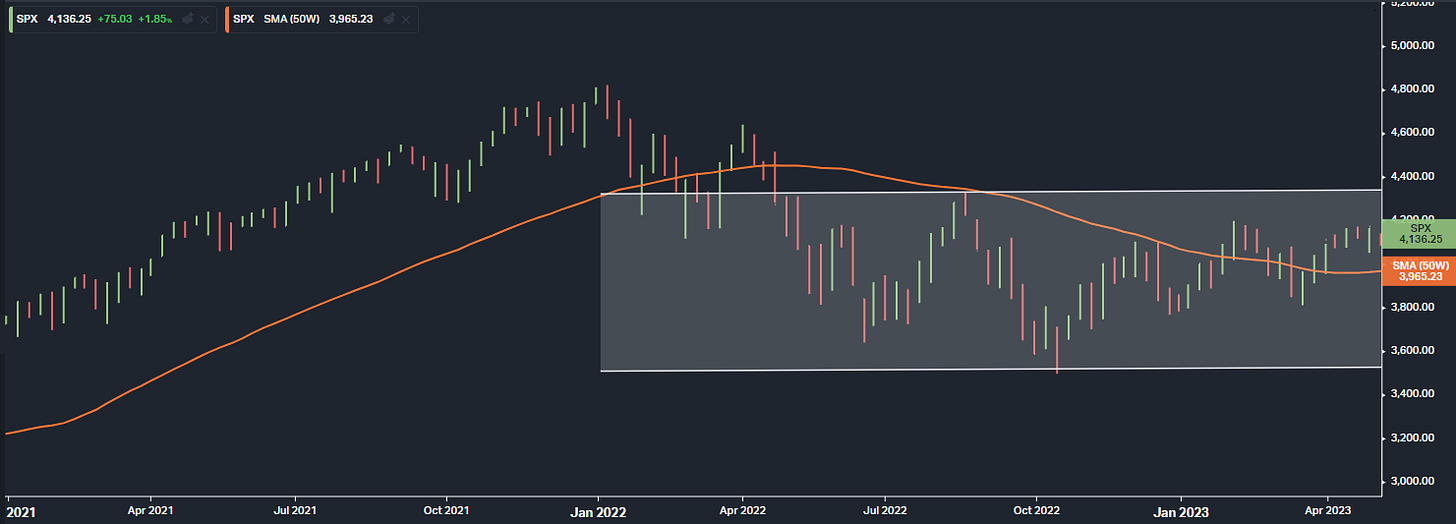

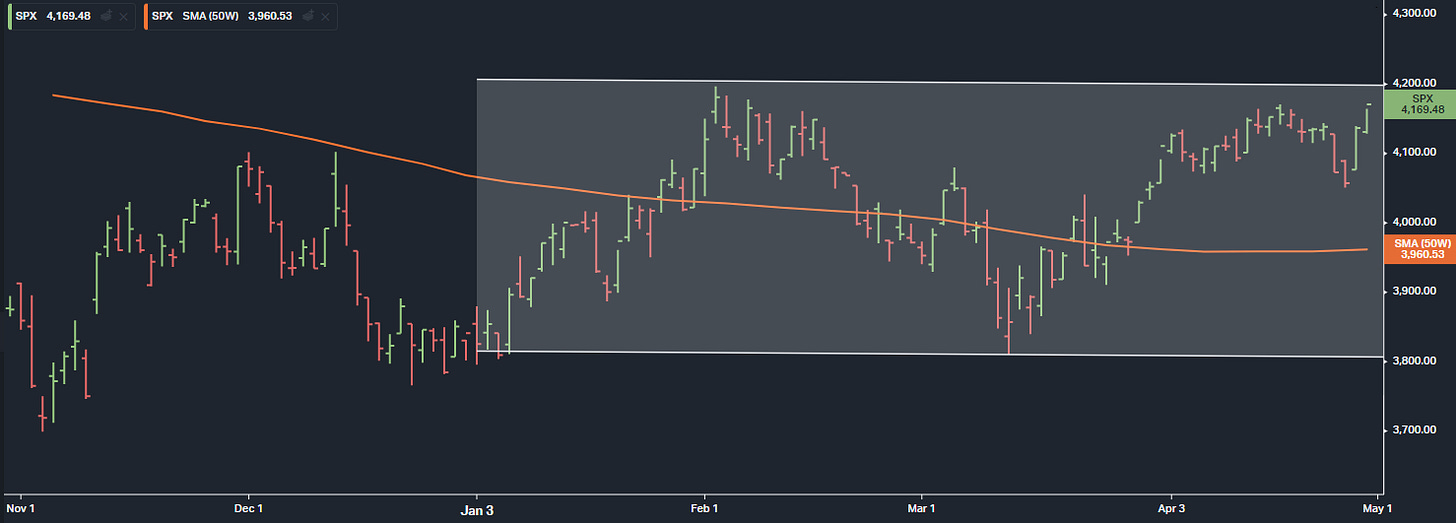

Home on the range: For almost a year, the S&P 500 has been stuck in a range, causing frustration for bulls and bears. Despite the Federal Reserve raising interest rates by 500 basis points, persistent inflation, slowing growth, earnings declines, and regional banking turbulence, the S&P 500 remains unchanged from a year ago.

As of April 29, 2022, the S&P closed the month at 4,132. Fast forward a year later, despite all that has happened, the S&P 500 concluded at 4,169. If you had slept throughout the past year, you may not think anything had happened.

You certainly wouldn’t think inflation was running at 40-year highs and that the Federal Reserve hiked rates by 500 basis points in response. You wouldn’t think that a widely followed recession indicator, the 2-10 yield curve, has been inverted for ten months, signaling an upcoming recession. Or that the housing market was essentially frozen for the past year.

While we appear stuck in an 800-point range between 4300 and 3500 for the S&P 500, zooming into this year more closely shows a tighter 400-point range between the March low of 3800 and the February high of 4200.

It is noteworthy that despite the second, third, and fourth largest bank failures in the US, the S&P 500 is only slightly below its 52-week high. This demonstrates the power of low expectations. At the outset of the year, the general agreement was that the economy was poised for a downturn and corporate profits would plummet.

Instead, rumors of the economy’s demise appear to be premature and corporate earnings, while not great, have been better than expected. This is not to say that we have a booming economy; rather, expectations were so low coming into the year that simply clearing them has been supportive of prices.

If the recent trend in economic data and corporate earnings remains in place, it wouldn’t be too surprising to see the market break out of this range to the upside.