August Market Review

"Thinking is to humans as swimming is to cats; they can do it but they'd prefer not to". - Daniel Kahneman

Executive Summary:

Seasonality reigns: Despite better-than-expected second-quarter earnings, stocks came under pressure in August as long-term interest rates and the US dollar rose, capping the rally as we move into a seasonally weak period.

Rising 10-year yields and Strong Dollar headwinds: The yield on the 10-year US Treasury rose to the highest level since November 2007, closing at 4.34 percent on August 21, eclipsing the prior cycle high set in October 2022. While easing over the last week, the path of interest rates over the near term could determine whether markets continue to advance or remain rangebound.

Q2 Earnings recap: With 98 percent of the S&P 500 companies reporting, earnings for the second quarter are expected to be $54.87/share, higher by 4.6 percent than Q1 and 16.8 percent higher from the year-ago quarter. This is according to data from S&P Global, which owns the S&P Dow Jones Indices.

The one with the Oregon Trail vibe: The Kansas City Federal Reserve Bank hosted its annual economic policy symposium in Jackson Hole, Wyoming, where policymakers and academics worldwide discussed the most pressing economic issues. This year's theme was "Structural Shifts in the Global Economy."

Seasonality reigns: Despite better-than-expected second-quarter earnings, stocks came under pressure in August as long-term interest rates and the US dollar rose, capping the rally as we move into a seasonally weak period.

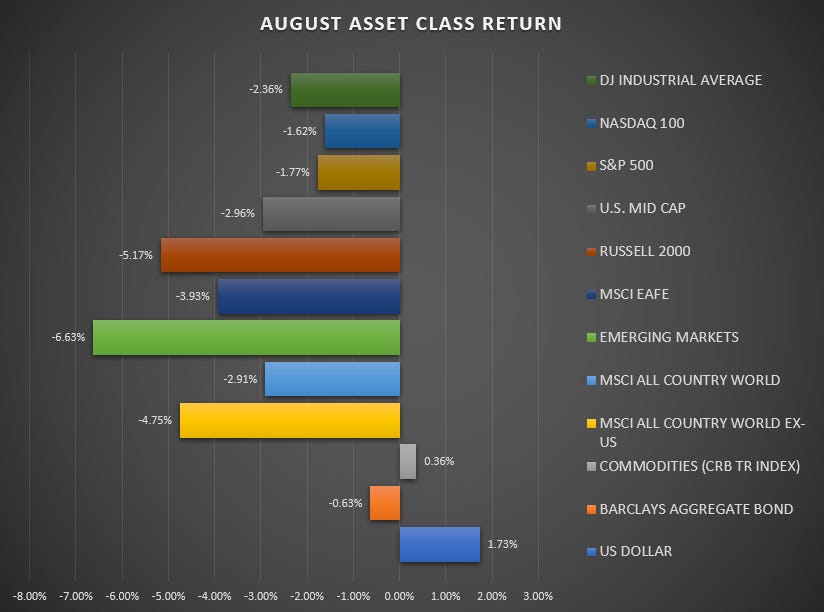

Emerging markets were the biggest losers in August, with their stock markets falling -6.6 percent. This was followed by a decline of -5.2 percent for the interest rate-sensitive small-cap Russell 2000 index. Developed international equities gave up -3.9 percent, and US mid-caps fell -2.9 percent.

US large-caps held up relatively well, thanks to a late-month rally that helped recoup most of the month's losses. The Nasdaq 100 finished the month down -1.6 percent after being down as much as -6.5 percent mid-month. The Dow Jones Industrial Average gave up -2.3 percent, and the S&P 500 finished the month down -1.7 percent.

September has historically been the weakest month of the year, with positive returns only 45% of the time and an average loss of over 1.1% since 1928.

However, a recent study by Carson Investment Research found some interesting data that suggests this year's September may differ from the averages.

The study looked at what happens when the S&P 500 is up over 15% through July and then has a down August. This has happened only nine times since 1928, including this year.

The study found that September was positive 89% of the time in these cases, with an average gain of 3.3%. The rest of the year (September through December) was positive 100% of the time, with an average return of over 11%. See the table below:

The above falls into the anecdata (anecdotes + data) category, and while interesting, I don’t place much empirical weight on this. But if you’re looking for a reason to be optimistic for the next few weeks, it’s as good as any.

The August decline may have reset investor sentiment and created a base for the market to move higher in the rest of the year. However, there are still a lot of uncertainties ahead, so I expect seasonal patterns to continue to play out and the market to remain rangebound (S&P 500: 4200 - 4600) into October as we work off excesses in both valuation and sentiment.

Rising 10-year yields and Strong Dollar headwinds: The yield on the 10-year US Treasury rose to the highest level since November 2007, closing at 4.34 percent on August 21, eclipsing the prior cycle high set in October 2022. While easing over the last week, the path of interest rates over the near term could determine whether markets continue to advance or remain rangebound.

One way to understand the 10-year treasury nominal yield, currently 4.09 percent, is to break it into its parts: inflation expectations and real yields.

The 10-year breakeven inflation rate measures market expectations for inflation over the next ten years. The current 10-year breakeven inflation rate is 2.24 percent. See below:

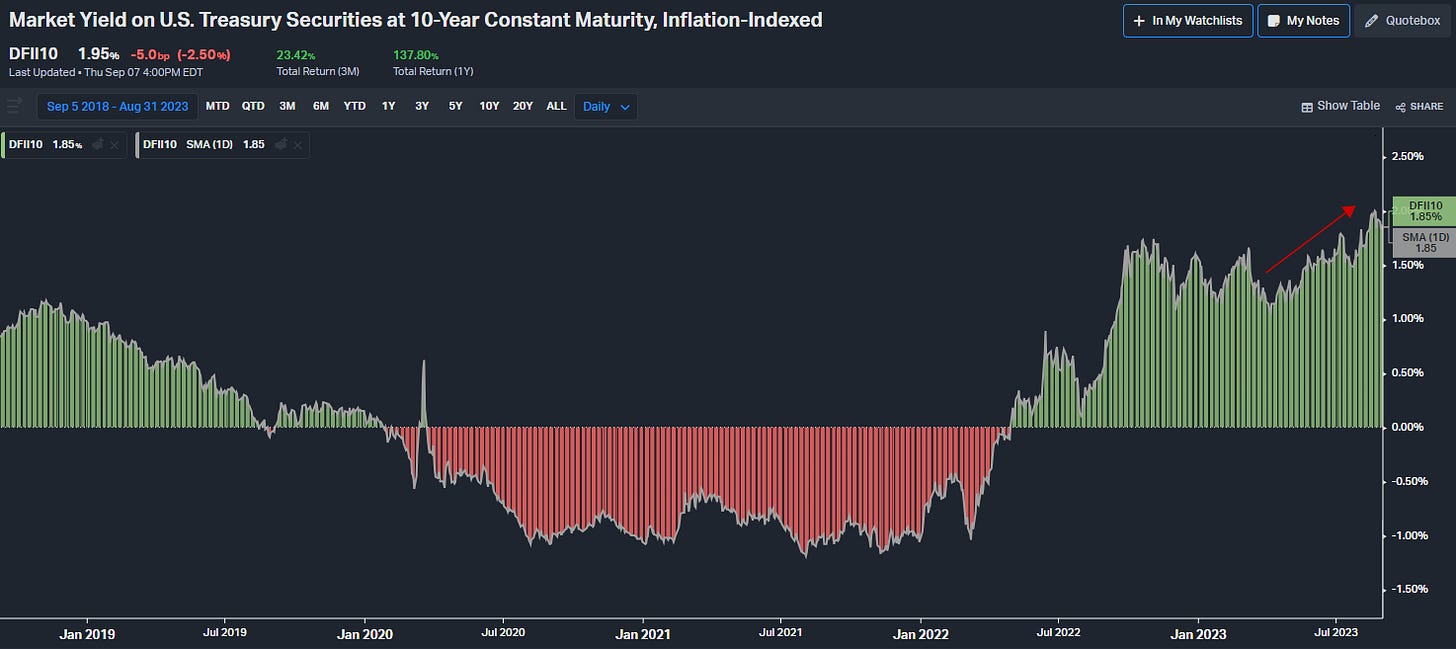

The real yield is the market yield on the 10-year US treasury adjusted for inflation. The US treasury's 10-year constant maturity, adjusted for inflation, currently yields 1.85 percent. See the chart below (red shading indicates a negative yield):

If you take the sum of both the 10-year breakeven inflation rate (2.24%) and the 10-year real yield (1.85%), you get the nominal yield on the 10-year US treasury (4.09%).

The increase in the 10-year nominal yield has been primarily driven by rising real yields, not by a change in inflation expectations, which appear firmly anchored, at least for now. Notably, inflation expectations peaked when real yields turned positive in April last year.

The move higher in real yields has also had a secondary effect of dragging the US dollar higher. While the correlation between real yields and the dollar changes over different economic conditions, recently, the two have shown a positive correlation.

The dollar had tested support three times around the 101.5 area and broke through in July, only to sharply reverse higher along with real yields, adding another headwind for equities. See below:

Rising nominal and real yields make it more expensive for businesses and consumers to borrow money, which tightens overall financial conditions. The rising dollar also makes US exports more expensive to foreign buyers, acting as a drag on corporate profits. The combination is a toxic mix for equity markets and will likely inhibit any near-term rally until conditions change.

Q2 Earnings recap: With 98 percent of the S&P 500 companies reporting, earnings for the second quarter are expected to be $54.87/share, higher by 4.6 percent than Q1 and 16.8 percent higher from the year-ago quarter. This is according to data from S&P Global, which owns the S&P Dow Jones Indices.

Of the 497 S&P 500 companies reporting earnings (out of 503), 377 beat estimates, 87 missed, and 33 met estimates. Margins expanded from 11.64 percent to 11.85 percent, indicating that company management has effectively contained costs and passed along any increased costs to the end consumer.

The most notable development this earnings season was that analysts raised their forward earnings estimates for the first time since July 2022. They now expect S&P 500 earnings to reach $220.2 per share in 2023, up from $216.8, and $246 per share, up from $243 in 2024.

Since the S&P 500 bottomed last October, the ensuing 32 percent rally has been driven by multiple expansion - investors’ willingness to pay more for a dollar’s worth of earnings rather than improving earnings. After missing the last two quarters of earning growth, analysts finally realized earnings may have troughed. And that’s a good first step in changing sentiment.

The one with the Oregon Trail vibe: The Kansas City Federal Reserve Bank hosted its annual economic policy symposium in Jackson Hole, Wyoming, where policymakers and academics worldwide discussed the most pressing economic issues. This year's theme was "Structural Shifts in the Global Economy."

Federal Reserve Chair Powell's speech contrasted sharply with last year's 8-minute address when he warned businesses and consumers to expect pain ahead. That speech triggered a 20% decline in the S&P 500 over the ensuing nine weeks.

Powell spoke for 15 minutes this year, and his message was consistent with last year's policy objectives. However, his tone was cautiously optimistic. In short, the Fed remains committed to bringing inflation down to target, which is necessary to achieve its dual mandate of full employment and price stability. The Fed has made significant progress without causing substantial damage to the economy. However, more work must be done, and the risk of doing too little to reign in inflation is greater than the risk of doing too much.

Powell described the Fed's challenge as "navigating by stars under a cloudy sky" due to the increased uncertainty caused by the post-pandemic economy. That seems an apt description of our current environment and doesn’t make their job easy.

Great write up!!! Thanks for sharing