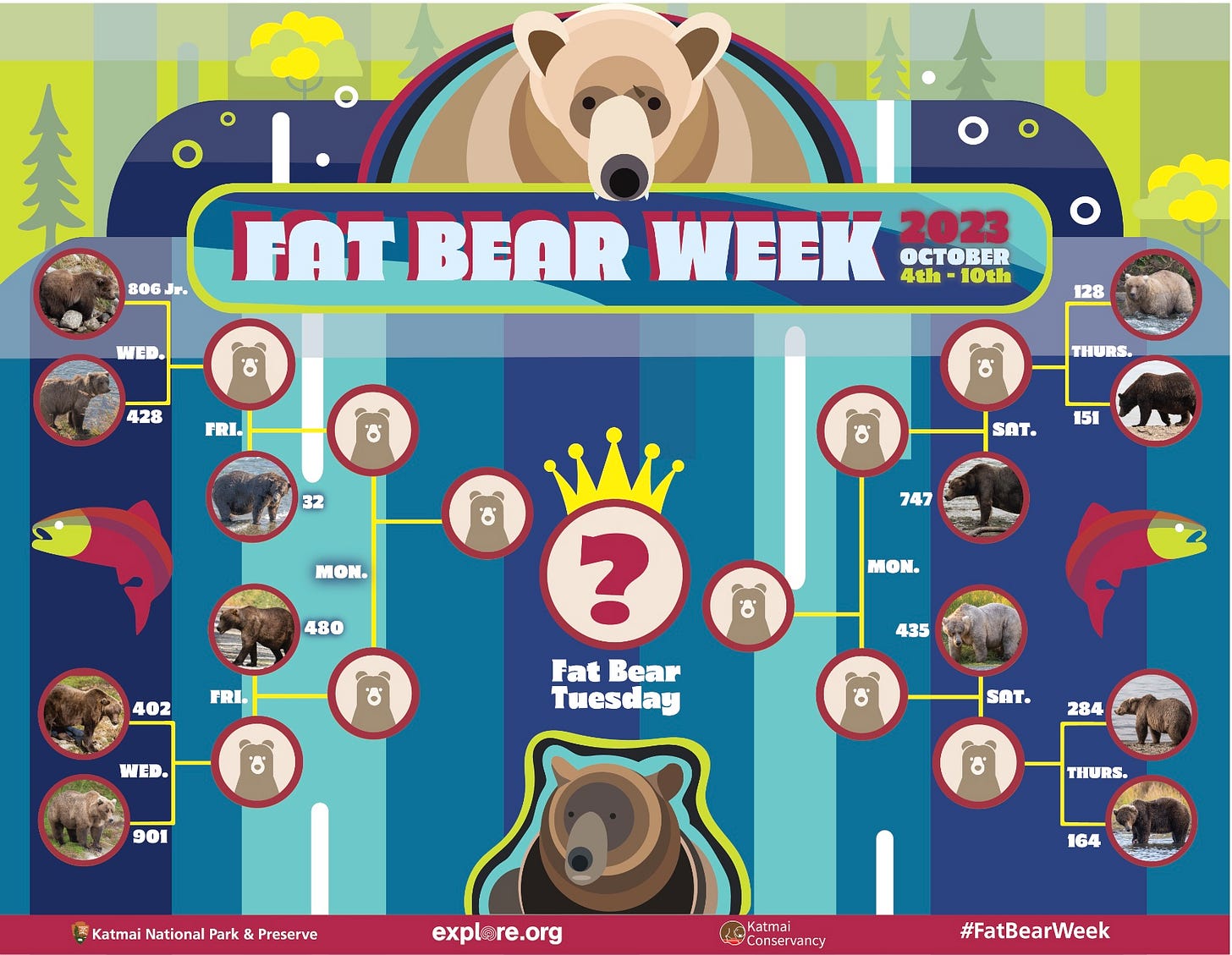

Another Fat Bear Week has come and gone.

For those who are unfamiliar, Fat Bear Week is an annual event sponsored by the Katmai National Park and Preserve in Alaska. Katmai National Park is home to over 2,200 brown bears, known to eat around 130 pounds of salmon daily, preparing for winter hibernation.

The brainchild of former park ranger Mike Fitz, who, along with colleagues, installed livestreaming cameras on the Brooks River in 2012 to observe bears standing in the river catching sockeye salmon.

Surprised by the heavy traffic of the livestream, in 2014, Mike organized a one-day event titled ‘Fat Bear Tuesday,’ in a not-so-subtle nod to Mardi Gras.

Park visitors were asked to review before and after pictures of bears and vote for the fattest bear in a single elimination tournament. The feedback was so overwhelmingly positive that in 2015, the tournament went digital and was extended to a week.

This year, over 1.3 million votes were cast, and the winner was a female brown bear known as 128 Grazer. With past winners, 128 Grazer is enshrined in the Fat Bear Hall of Champions.

Speaking of fat bears, the last few months have proved to be fertile grounds for stock market bears. Since peaking in July, markets have been under pressure for various reasons: rising 10-year yields, higher oil prices, and a stronger dollar.

The peak-to-trough declines from the July 31 highs to October 3 saw the S&P 500 fall by -7.8%; the Nasdaq 100 lost -8.05%, MSCI EAFE decline -10%, US Mid-Caps lose -10.7%, emerging markets give up -11.2%, and US Small Caps lose-13.8%.—nine straight weeks of seemingly unrelenting declines.

Despite rising geopolitical tensions, stock markets have been trying to find a bottom since the start of Fat Bear Week. We've seen rallies of 2-3% across the board but in fits and starts.

Are stock market bears sated enough to hibernate for the winter, or is there more downside ahead?

There are a few things that we need to see before declaring any low. The headwinds of higher 10-year yields, rising energy prices, and a rising dollar need to diminish.

Early signs indicate that this may be happening. Yields on the 10-year Treasury appear to have topped out. Remember that yields don't need to fall; they only need to stop rising, especially at the pace we've seen over the last few months.

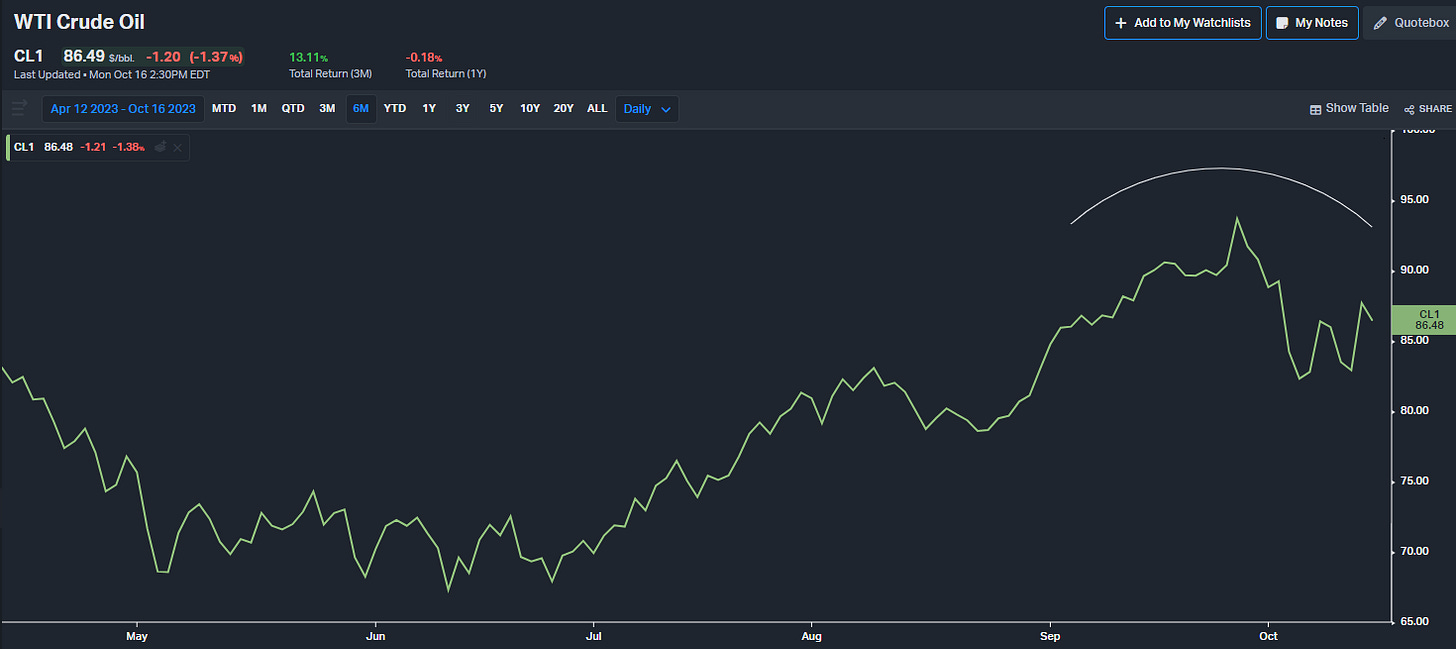

Oil and gas prices skyrocketed recently, stoking inflation fears and squeezing consumers. West Texas Intermediate crude oil surged +38%, from a low of $68 per barrel in June to a high of $94 in September. It's too early to say if crude oil prices have peaked, especially given current events. But if the pullback continues, it will ease immediate concerns about inflation.

The final puzzle piece is reversing the US dollar's meteoric rise. The dollar has gained 7% in the past three months, but there is a good chance this momentum has run out. This will be particularly true if, as several Federal Reserve Board members recently indicated, the Fed is done hiking rates this cycle.

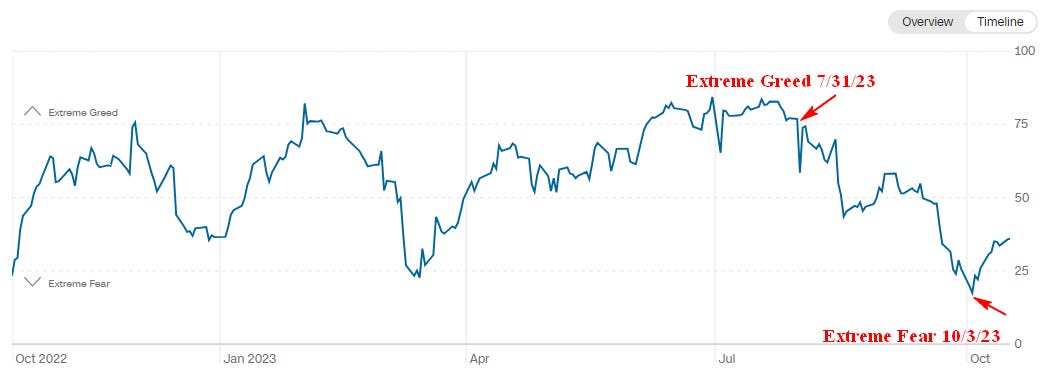

The past few months’ decline has accomplished a few things. Market valuations have fallen from 20x forward estimates to 18x. Falling markets have also helped reset investor sentiment. Below is the CNN Fear and Greed Index, which uses seven market indicators to measure investor sentiment; since July, sentiment has fallen from extreme greed (when investors are well served by exercising caution) to extreme fear (indicating opportunity for wise investors).

While there’s no guarantee of a rally into the new year, a few conditional elements appear to be falling into place: valuations have moderated, long-term interest rates have stopped moving higher, oil prices have taken a hit, and investor sentiment is now negative.

Over the short run, the key is having a few back-to-back positive days for the market. If we can get that, it makes it more likely we see typical fourth-quarter seasonal strength into year-end.