It’s my favorite time of year, once again.

Not because it’s my birthday month (don’t ask how old I am) or because Christmas is tomorrow (although the annual Oahu trip with family to ring in the new year is pretty sweet).

No, it’s because of the lull between Thanksgiving and Christmas. That magical time when Wall Street’s finest minds take a break from their spreadsheets and gaze into a crystal ball for the coming year. Prognostications abound about the economy, interest rates, and all the rest as experts attempt to predict where the stock market will be in 365 days.

I’m the first to admit this prediction game is silly - the future is, by definition, unknowable. Like trying to predict the weather a year from now, you might get lucky, but chances are just as likely you’ll be way off.

Even Wall Street strategists know their forecasts are educated guesses. They’ll readily tell you things can change in a heartbeat, and their carefully crafted predictions will be blown to bits by unforeseen events. But the public loves this stuff, so the game goes on.

While neither participating in assigning 12-month price targets to the S&P 500 nor is it rational to manage money in that fashion - our clients’ time horizons span years and decades - we nonetheless pay attention.

Listening to their predictions is like eavesdropping on a conversation between a bunch of really smart people. Whether we agree with them or not, these analysts give us a peek into their playbooks - their worldviews, hopes, and worries.

To set the table, consider that the S&P 500 grew at a compound annualized growth rate (CAGR) of 13.2% for the last five years, which includes a global pandemic and two regional wars. In the previous ten years, it grew by 9.67% and, for the past 20 years, it grew by 7.41%.

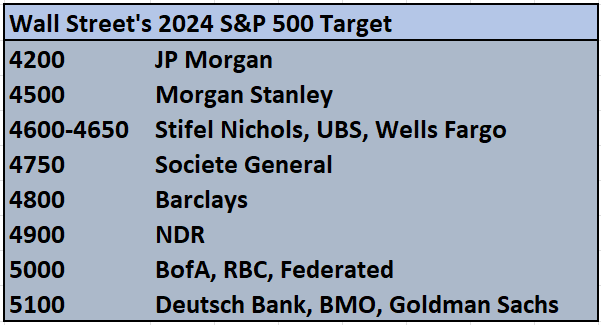

So, what are the best and brightest on Wall Street saying about 2024? Well, they’re not exactly bursting with optimism. The average of all forecasts is for a measly 1% return on the S&P 500. That’s a far cry from the +20% gains this year.

Even the most optimistic among them believe in only high single-digit returns, which is unusual for a group that’s typically over-optimistic.

The strategists above fall into three broad groups: the doomers, gloomers, and meh-ers. (Doomers, gloomers, and boomers would be more alliterative, but I wouldn’t say calling for a 7% return next year is “boomish.”)

The doomers believe that a recession in the US and Europe has only been delayed, not avoided. Developed economies remain on a recessionary path unless global central banks ease monetary policy significantly. Earnings estimates are overly optimistic, which will ultimately disappoint in the end. The combination of high equity valuations, elevated interest rates, a weakening consumer, and rising geopolitical risks is an environment hostile to risk assets, creating an unfavorable risk-reward.

The gloomers believe earnings will grow next year, though not at the 13% priced into current estimates. While a recession should be averted, if one does arrive it should be mild, with economic growth uneven and sluggish. Gloomers see the largest stocks in the S&P 500 - the Magnificent 7 of AAPL, AMZN, GOOGL, META, MSFT, NVDA, and TSLA - struggling in 2024 as their excessive valuations (28x forward earnings for the group) compress, while the bottom 70% of stocks (16x forward earnings) should fare better. This push-pull between the large and small stocks will leave the S&P 500 +/- a few percentage points of where we are now. Gloomers are not predicting a crash, but they aren’t expecting fireworks either.

Meh-ers are just kind of...meh about the whole thing. They believe that the economy is on the mend, with the pandemic’s sting slowly fading. Inflation, once raging, has retreated, supply chains have normalized and are humming along, and consumers, having satisfied pent-up demand, are finally taking a breather. They see that the Fed, sensing the chill in the air, has eased up on rate hikes and even hinted at potential rate cuts next year. This, combined with healthy consumer and corporate balance sheets (both padded by a pandemic-era feast of cheap loans and mortgages), paints a picture of financial stability. The job market, another bright spot, continues to churn out opportunities, keeping the unemployment rate comfortably low. So, for the “meh-ers,” the market’s future resembles a gently winding incline, a meandering vibe. For now, they are content with a market that’s just...meh.

Remember the pessimism that shrouded last year? It felt like everyone was expecting the sky to fall. For 2024, the mood has lifted. Expectations are subdued but positive, with the bar set low enough that we may all be in for a happy surprise once again.