July Market Review

“Don't underestimate the power of resting. It builds you back unlike anything.” ― Hiral Nagda

Executive Summary

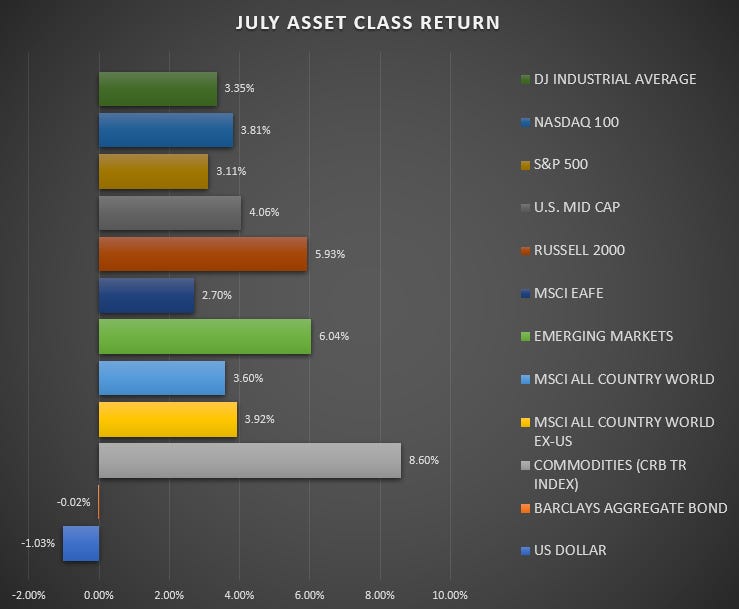

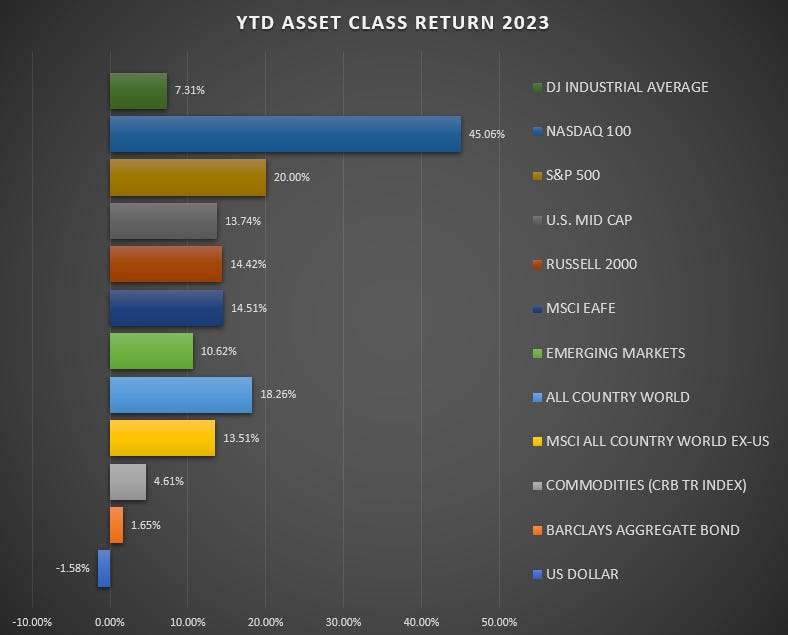

The US equity markets have been on fire: The US equity markets have been running “Hot, Hot, Hot!” and July was no exception. The big three headline indexes all posted gains, with the S&P 500 adding +3.1 percent, the Dow Jones Industrial Average +3.3 percent, and the Nasdaq 100 tacked +3.8 percent, bringing its year-to-date total return to an embarrassing +45 percent.

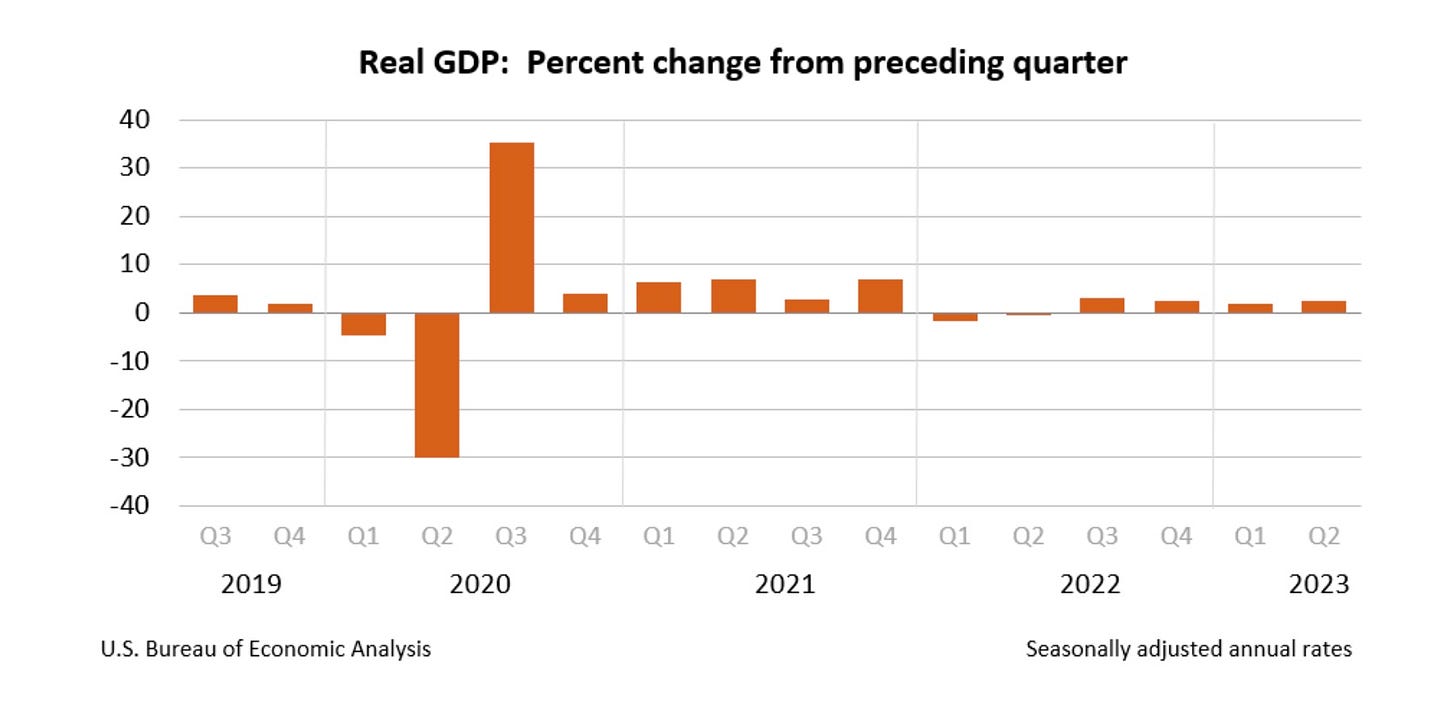

Economy surprises to the upside: Second quarter Gross Domestic Product (GDP) increased at an annual +2.4 percent rate for the second quarter of 2023. This was well ahead of analyst expectations of a +1.8 percent annualized growth rate, and the economy defies skeptics.

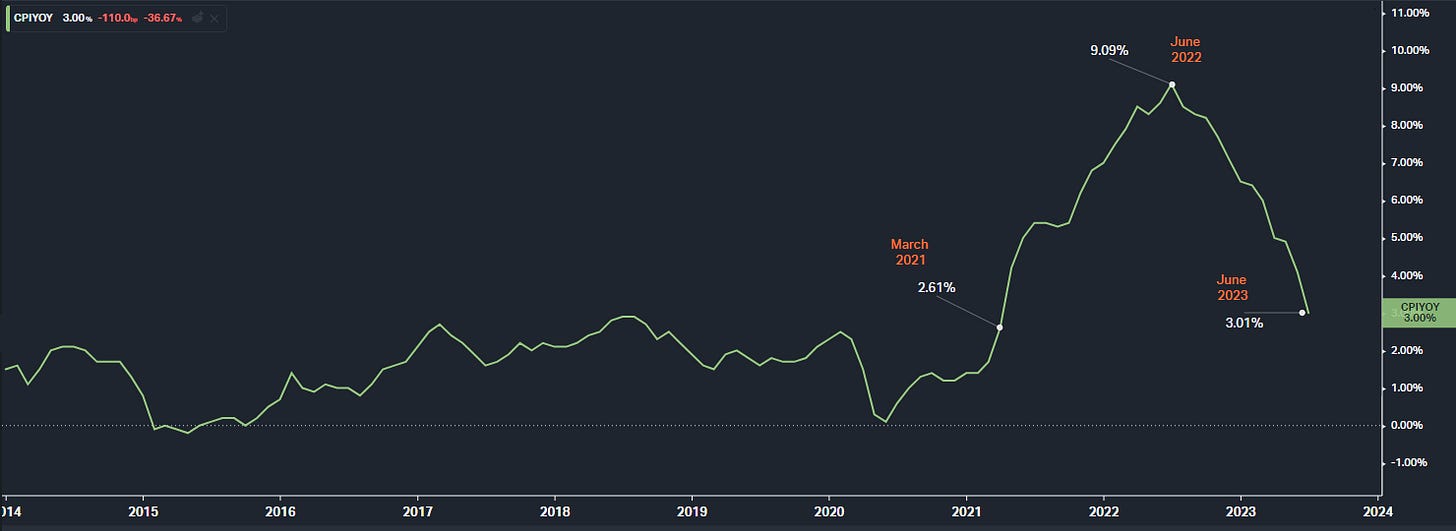

Has inflation bottomed?: The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.2% in June, following a 0.1% rise in May. This is the 12th consecutive month inflation has declined, but it remains elevated compared to historical norms. Over the last 12 months, the all-items index has risen 3.0%.

The US equity markets have been on fire: The US equity markets have been running “Hot, Hot, Hot!” and July was no exception. The big three headline indexes all posted gains, with the S&P 500 adding +3.1 percent, the Dow Jones Industrial Average +3.3 percent, and the Nasdaq 100 +3.8 percent, bringing its year-to-date total return to an embarrassing +45 percent.

But the emerging story lies beyond the headline indexes, which may have implications for the remainder of the year. The outperformance of Small and mid-sized US companies that began last month continued apace throughout July, with small caps adding +5.9 percent and mid-caps adding +4.0 percent. This broadening of performance from large to small and mid-caps suggests the advance in the market has more room to run.

Developed international equities posted gains of +2.7% while emerging markets added +6.0. Commodities also had a strong performance in July, sprinting higher by +8.6 percent and moving into positive territory this year. This move was primarily driven by a +15.3 percent move higher in crude oil.

The Barclays Aggregate Bond Index was unchanged for the month, while the US dollar gave up -1.0 percent.

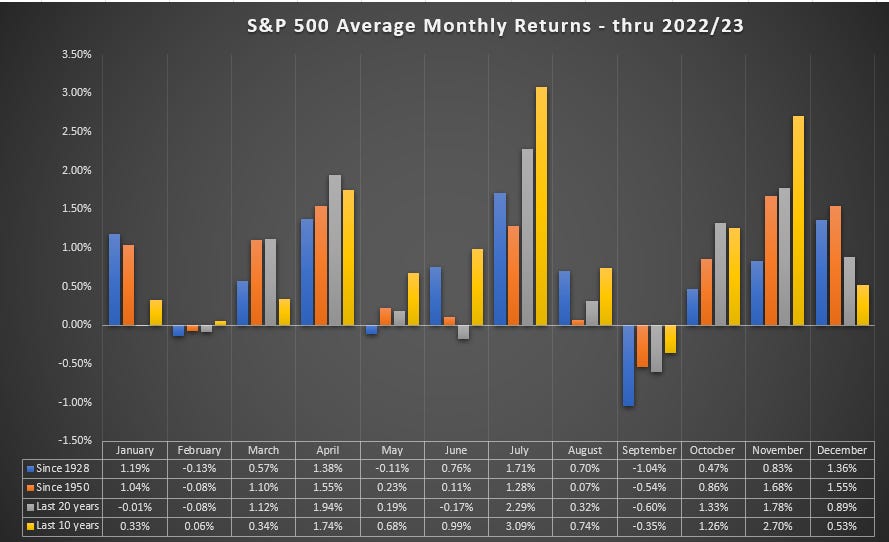

After such a torrid run, it wouldn’t be surprising to see the markets take a bit of a hiatus as we move through the “dog days of summer.” As the chart below illustrates, we are entering a seasonally weak period for the markets.

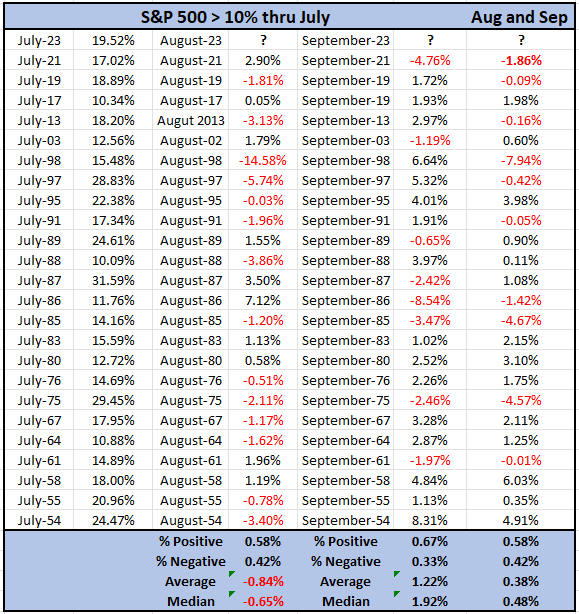

The table below shows the times that the S&P 500 was higher by 10 percent or more heading into the August - September timeframe since 1950. This has happened 24 times before this year -results are below.

Historically, August and September have more positive than negative outcomes; however, the magnitude of the average August decline more than offsets gains for the month. Taking the two-month returns together leaves an average gain of less than half of one percent.

It’s not terrible, but is reason enough to have muted expectations for the next couple of weeks as the market digests its gains.

Economy surprises to the upside: Second quarter Gross Domestic Product (GDP) increased at an annual +2.4 percent rate for the second quarter of 2023. This was well ahead of analyst expectations of a +1.8 percent annualized growth rate, and the economy defies skeptics.

The consumer showed considerable strength as this report showed increased goods and services spending. An increase in nonresidential fixed investment, government spending, and inventory growth also acted as a tailwind to this report.

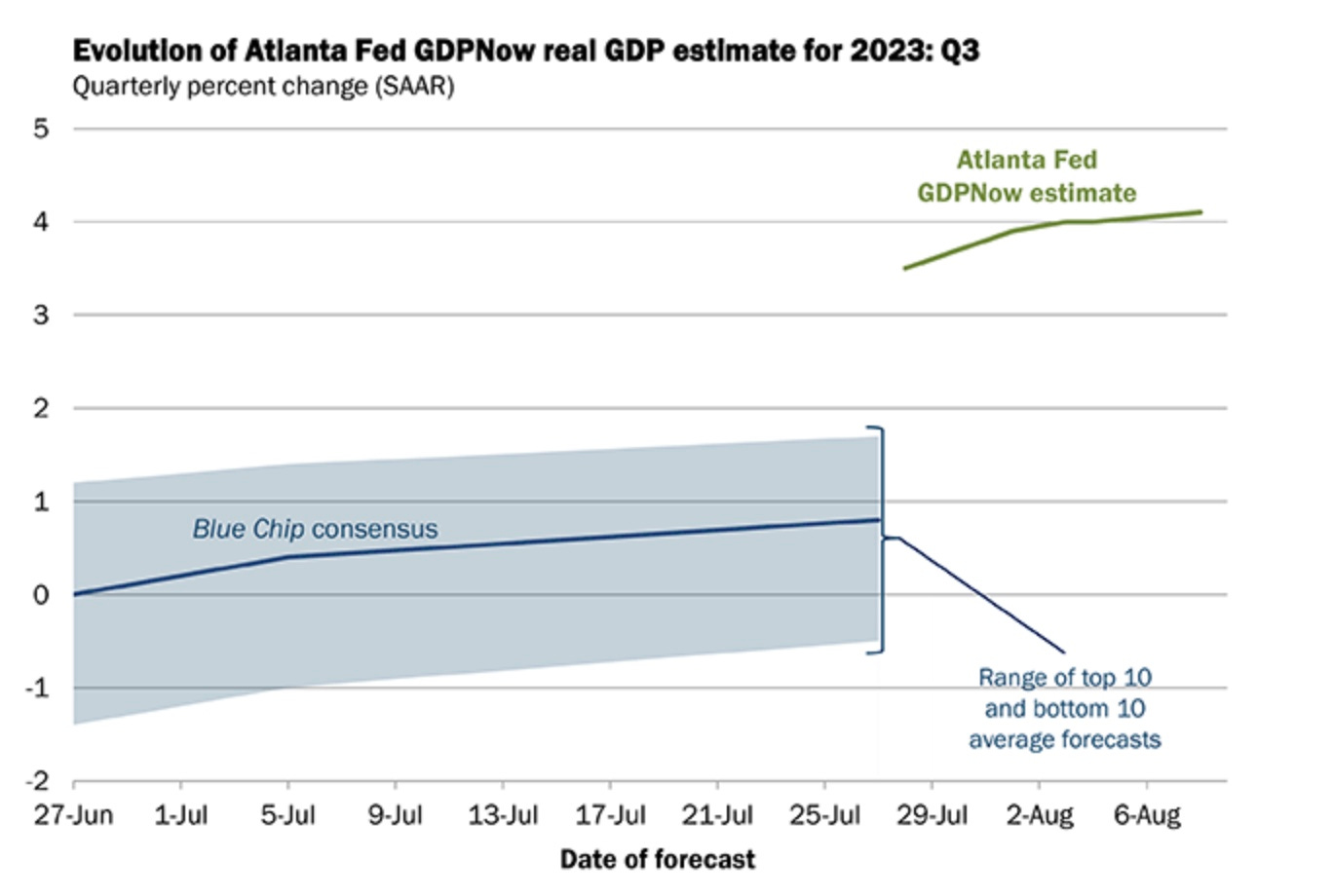

Of course, this is the initial report based on source data that may be incomplete as there are two additional revisions to come. That being said, looking at initial estimates from the Atlanta Federal Reserve third quarter GDP estimate, economic growth is accelerating. See below.

Economic growth continues apace, propelled by both consumer spending and private investment. Early indications suggest economic growth may accelerate into the third quarter as businesses continue to invest in new projects and the consumer remains confident in the economy and jobs market.

Has inflation bottomed?: The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.2% in June, following a 0.1% rise in May. This is the 12th consecutive month inflation has declined, but it remains elevated compared to historical norms. Over the last 12 months, the all-items index has risen 3.0%.

Core inflation measures, excluding food and energy, rose 0.2% in June and 5.7% over the last 12 months. This suggests that inflation is not only being driven by volatile food and energy prices but by more fundamental factors such as rising wages and rents.

The chart below shows the Consumer Price Index for All Urban Consumers (CPI-U) (green), with March 2021 highlighted as the last time it was below 3%. It took 15 months for inflation to peak at 9.1% in June 2022. Since then, inflation has declined for 12 consecutive months, ending with a year-over-year reading of 3% in June.

The chart below shows the two inflation measures: CPI-U (green) and core CPI-U (blue). As you can see, CPI-U has mostly round-tripped its move higher, but core inflation has remained stubbornly persistent. This suggests we may not see a further decline in headline inflation until core inflation cools off.

There is hope that inflation could start to cool off in the fall, as rental prices have been moderating for months. Housing is one-third of the core measure of inflation, so a decline in housing or Owners' Equivalent Rent (OER) could significantly impact overall inflation.

However, there are additional challenges that need to be considered. First, the impact of high month-over-month inflation readings from a year ago is diminishing in the yearly calculation, posing challenges to further progress. For instance, if the inflation rate for July matches that of June, which was 0.2%, the annual increase in headline inflation would jump to 3.3% in July simply because the monthly reading in July 2022 was 0.0% and is excluded from the calculation.

The second headwind is the energy complex, which surged higher during July. Heating Oil climbed +21.6 percent, West Texas Intermediate Crude Oil gained +15.2 percent, and Gasoline rose +14.3 percent. Too early to call this a trend; however, this move shouldn’t be ignored as the path of least resistance for now suggests higher energy prices.

The inflation news has been surprisingly positive lately and much better than even optimists could hope for. Yet further improvement from here will be challenging. Given the Federal Reserve's intention to bring inflation back to its 2 percent target, any lack of forward progress opens the door to additional tightening and increases the chances for a policy mistake.