Well, that was no fun: September's returns were disappointing. As we've discussed, seasonal weakness tends to occur from August to early October, with September being the historically weakest month. This year was no exception. Four of the last five Septembers have seen negative returns, with an average decline of -4.3%.

Federal Reserve - Rate Pause and Updated SEP: The Federal Reserve met on September 20 and announced that it would maintain the target range for the Federal Funds Rate at its current level, 5-1/4% to 5-1/2%.

Well, that was no fun: September's returns were disappointing. As we've discussed, seasonal weakness tends to occur from August to early October, with September being the historically weakest month. This year was no exception. Four of the last five Septembers have seen negative returns, with an average decline of -4.3%.

The September performance was caused by several factors, including ongoing strikes by the United Auto Workers and the Actors Guild (as well as the recently settled Writers Guild), the resumption of student loan payments, the looming government shutdown (averted at the last minute), the rising price of crude oil (up 8.5% in September and 28% this quarter), the rising yield on US 10-year Treasury notes (up .5% in September, touching levels not seen since 2007), and the relentless climb of the US dollar (higher for eleven consecutive weeks).

Despite the recent weakness in the stock market, there are signs of hope. The government shutdown has been averted, albeit temporarily, and yields, the dollar, and oil have all pulled back from recent highs. Inflation is also declining faster than expected, earnings are being revised higher, and stock market valuations have fallen from 19.5x forward estimates to 17.5x, becoming more attractive. Additionally, we are entering the strongest seasonal period for equity market returns, so we have that going for us.

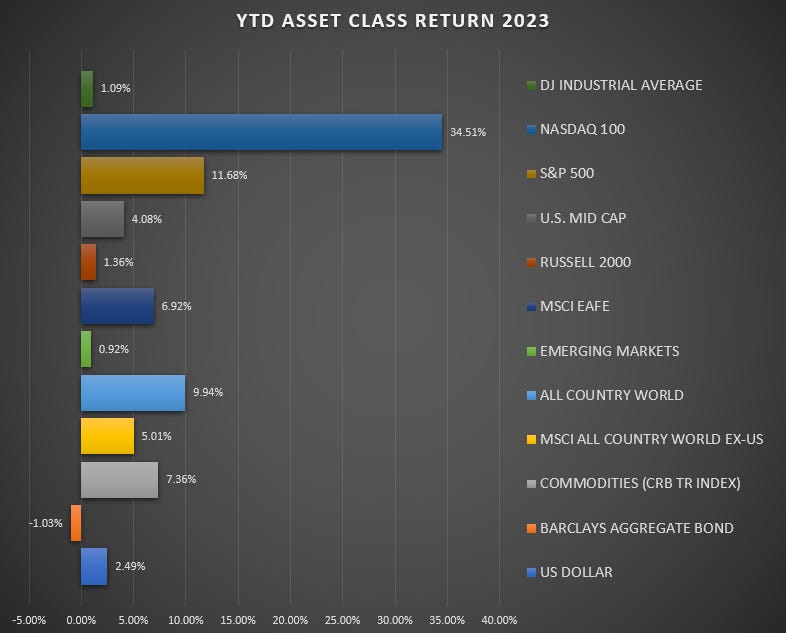

The biggest question is whether this two-month pullback has been deep enough to provide a base upon which markets can rally into year-end. At the index level, the S&P 500 declined -6.6% from the July highs, while many of this year’s leaders (Apple, Tesla, Microsoft, Nvidia, Alphabet) have seen double-digit declines. In the next few weeks, we should be able to discern if these positive seasonal trends will hold.

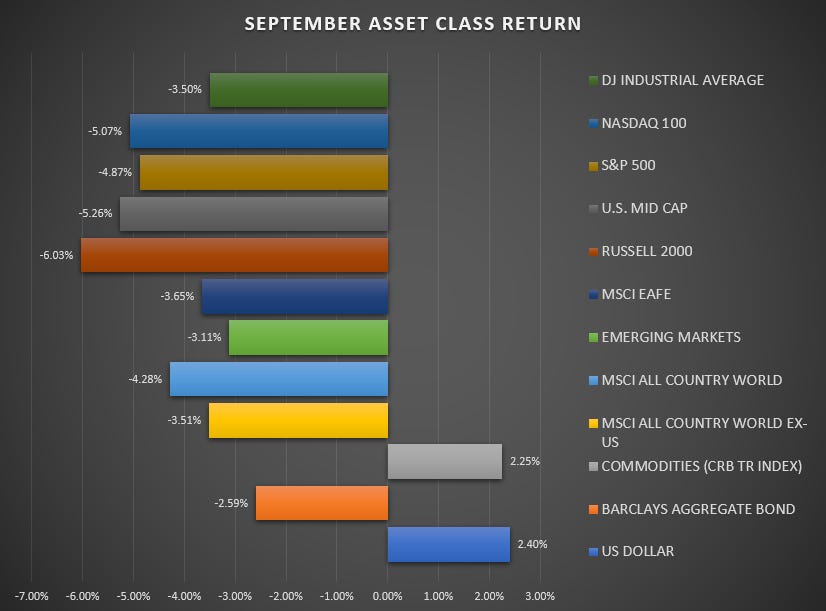

September by the numbers: US small-cap stocks were the hardest hit in September, falling 6% and over 10% in the past two months. This leaves them barely positive for the year. US mid-cap stocks lost -5.26%, the Nasdaq 100 lost -5.07%, the S&P 500 declined 4.9%, and the Dow Jones Industrial Average fared the best among the major indices, only falling -3.5% for the month.

International stocks also fell, with developed international markets down -3.65% and emerging markets down -3.1%. The MSCI All-Country World Index ex-US fell -3.5%.

The US dollar and commodities rose for the month, gaining 2.4% and 2.25%, respectively.

The benchmark Barclays Aggregate Bond Index fell -2.6%, erasing year-to-date gains and leaving the index down -1.05% for the year. If the index finishes 2023 in the negative, this would be the third consecutive year of negative returns, which has never happened before.

Federal Reserve - Rate Pause and Updated SEP: The Federal Reserve met on September 20 and announced that it would maintain the target range for the Federal Funds Rate at its current level, 5-1/4% to 5-1/2%.

This decision was widely expected; however, Fed Chair Powell indicated they may need to make one additional increase in the Federal Funds Rate before year-end, depending on incoming data. Recent data suggests economic activity continues to expand steadily, job gains have slowed along with wage gains, unemployment remains low, and inflation remains elevated.

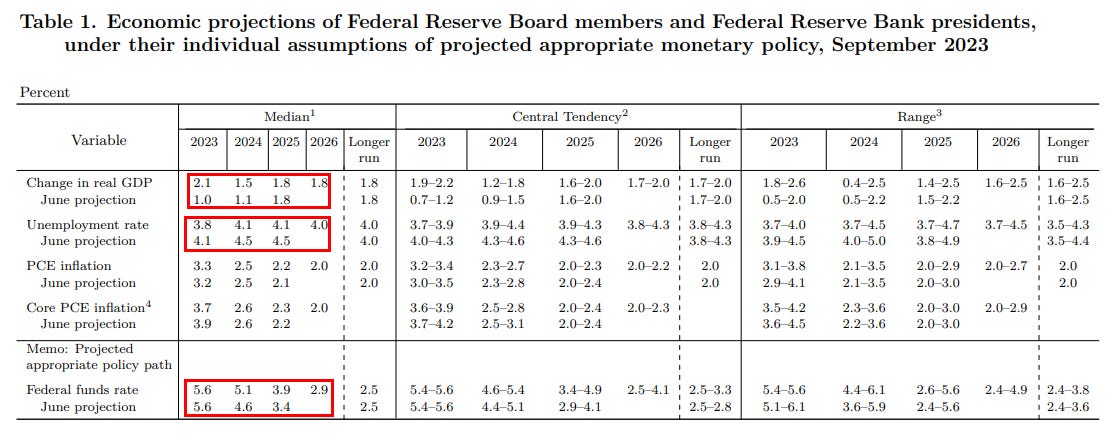

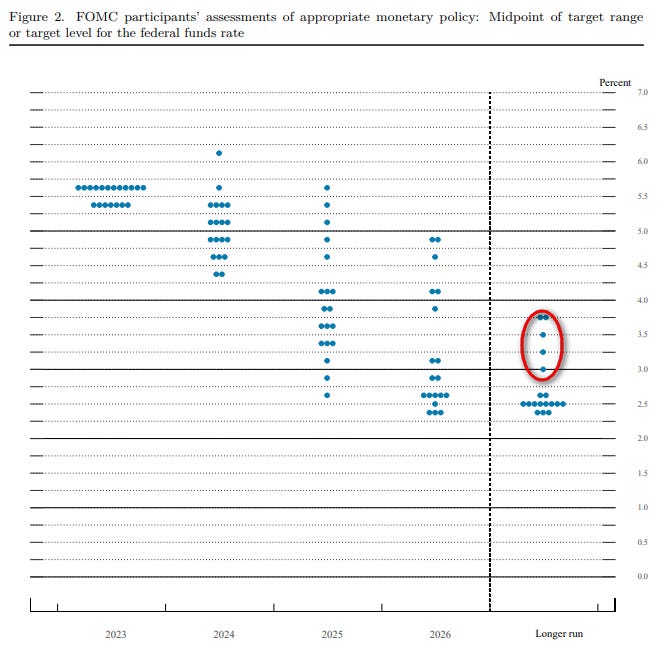

As they do quarterly, the Federal Reserve Board Members and Bank presidents updated their assumptions regarding the economy and appropriate monetary policy in the Summary of Economic Projections (SEP). These quarterly projections are widely anticipated by the economic community as the Fed’s perspective shapes monetary policy.

Notable are the revisions for higher economic growth in 2023 and 2024 (2.1% vs. 1.0% for 2023 and 1.5% vs. 1.1% for 2024) along with the lower revisions for unemployment (3.8% vs. 4.1% for 2023 and 4.1% vs. 4.5% for 2024). Both revisions acknowledge the surprising resilience and strength of the US economy.

However, the Federal Funds Rate (FFR) revisions captured market participants' attention. While the projected FFR for 2023 was unchanged, they removed two previously telegraphed rate cuts in 2024 (5.1% vs. 4.6% in 2024 and 3.9% vs. 3.4% in 2025), emphasizing the Fed’s messaging that the FFR will remain “higher for longer.”

The number of Fed members who think the long-run neutral FFR is above 3% increased in a way that went mostly unnoticed, but I found it interesting (see the red circle in the table below). As a reminder, the neutral rate is the rate at which monetary policy neither speeds up nor slows down the economy.

In past SEPs, only two people (visionaries? cranks?) thought the long-run neutral rate was 3% or higher. But in the latest SEP, three more people joined them. This may indicate that more Fed members believe the US economy has changed permanently since COVID-19, with unemployment staying low and the economy growing much faster than it has in the past decade.

If that's the case, it's a big deal for monetary policy going forward, implying the Fed may need to raise interest rates more than investors anticipate, and keep them elevated to control inflation.