Last year was a roller coaster. Unexpected twists and turns kept us on our toes, with both delightful and disappointing surprises. While a full recap is beyond this scope, here are some key events, non-events, and developments that will leave a lasting mark, not just on the economy but quite possibly on how we live and work in the years to come.

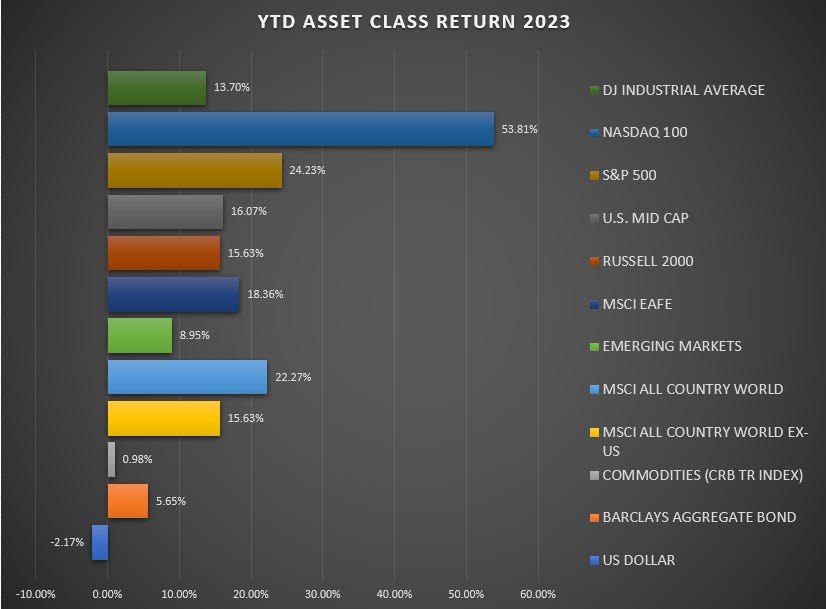

The biggest surprise? A year-end rally that defied expectations. 2023 started with equity markets slowly grinding higher as economic news consistently beat expectations, briefly interrupted by a scare that was quickly shaken off in March. The rally continued through July and just slowly deteriorated throughout the fall, leaving most indices in negative territory as late as October.

Take a look at the return table below. By the end of October, the Russell 2000 was off -5.6 %, having fallen over 19% since July. Bonds were down -2.6 %, having lost 5% in three months. Emerging markets were down -2.4% on the year, having lost -14 %, and US Mid Caps, having been up over +13% in July, were now down -1.2%. The Dow? A laggard all year went from up +7.3 in July to flat for the year. Things looked pretty bleak at the time.

Then, like a well-timed crescendo, markets exploded in the final two months. The catalyst? There were two key signals: first, the treasury signaled they would issue fewer-than-expected bonds, and second, the Fed holding rates were steady again in November, hinting at the end of the tightening cycle.

This sent speculation into overdrive. The mere possibility of future Fed rate cuts, since confirmed by the Federal Reserve’s December SEP outlining three cuts in 2024, was like igniting a rocket under the market. Yields fell, the US Dollar fell, and a broad-based rally was on.

Remember those October woes? By December, they were a distant memory.

In no particular order, here are a few of the most interesting developments that helped shape the year.

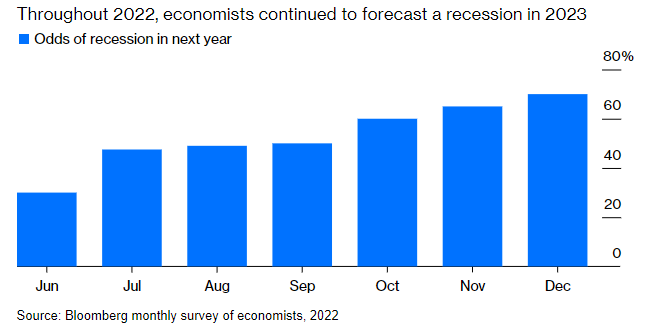

Recession averted: One year ago, expectations for the economy were low due to the awful bear market in 2022 and the Federal Reserve's determination to slay inflation no matter the cost. In a survey by Bloomberg at the end of 2022, over 65 percent of economists believed there would be a recession in 2023. Bloomberg Economics, the forecasting arm of Bloomberg, believed a recession in 2023 was a certainty, assigning it a 100% probability

This was understandable, given we all studied the same textbooks. Reducing demand for goods and services is the only way to bring inflation down when inflation is running hot.

The transmission mechanism is through interest rates. When the Fed raises interest rates, the cost of capital increases. As a result, business investment slows, leading to layoffs and increased unemployment, reducing overall demand as consumer households retrench. It's a process that’s painful and well-documented.

Few believed the economy could achieve a 'soft landing,' where inflation slows without the associated pain of increased unemployment dampening growth. After one of the most aggressive tightening cycles ever, the Federal Reserve hinted that we might be tantalizingly close to that. Two of my favorite 2023 charts are below.

Inflation:

Unemployment:

Inflation dropped from its peak of 9.1% in June 2022 to a reading of 3.4% in December. The unemployment rate remained relatively stable; it stood at 3.6% in June 2022 and was 3.7% in December.

Adding insult to consensus forecasting injury, the economy grew at a blistering 4.9% pace in the third quarter and has so far avoided recession. The estimated total year-over-year growth for 2023 (Q4 to Q4) is about 2.6%. At the beginning of the year, economists predicted less than one-half of one percent growth for the entire year.

It will be interesting to see how the future policy debates unfold as academics study this period, trying to make sense of the past three years. There is no debate, however, about how remarkable 2023 was and that the outcome far exceeded even the most optimistic expectations.

Regional Banking Crisis a flash in the pan, not an inferno: Market watchers warned that the Fed's aggressive rate hikes to tame inflation would have consequences; history suggested that, eventually, something would break. Those expectations materialized in early March with a whimper rather than a bang.

Silicon Valley Bank (SIVB), reeling from hold-to-maturity (HTM) bond losses in their portfolio inflicted by the Fed's tightening grip, offloaded $21 billion in securities, triggering a $1.8 billion loss. Panic rippled through SIVB's high-profile clientele, and in a (digital) bank run for the ages, $42 billion, a quarter of their deposits, vanished within hours. Insolvent and drained of liquidity, SIVB became the second-largest US bank failure ever, igniting industry-wide jitters.

On the same day, Signature Bank of New York (SBNY) saw 20% of its deposits evaporate, victims of fear spreading like wildfire. The New York State Department of Financial Services, acting swiftly, shut down SBNY, the third-largest US bank failure in history.

These events, as expected, sent shockwaves through the banking industry, leading equity investors to sell first and ask questions later. Below is a chart of the S&P Regional Banking Index (KRE).

The market shuddered, but this crisis remained localized, unlike 2008's devastating storm. First Citizens Bank acquired SIVB, New York Community Bancorp swallowed SBNY, and JPMorgan Chase absorbed First Republic Bank, an unfortunate casualty of the turmoil.

Crucially, no customer lost a penny thanks to the FDIC's safety net. The system, albeit tested, held firm. As fear subsided, the Regional Bank Index clawed back most of its losses by year's end.

The 2023 regional banking crisis was an affirmation of the policies put in place post-GFC. Vulnerable institutions were quickly ring-fenced, liquidity was available for those who needed it, and assets were disposed of quickly without customer losses.

It was a flash of fear, a tremor, but not a seismic event. Ultimately, it underscored the resilience of the American banking system and the critical role of institutions like the FDIC in safeguarding depositors' trust.

Artificial Intelligence (AI) sparks investors’ imagination: Investors were captivated by the possibilities that artificial intelligence offered, especially with the mainstream introduction of ChatGPT (full name Chat Generative Pre-trained Transformer). This remarkable chatbot was unveiled in November 2022 by OpenAI. It is estimated that ChatGPT had reached 100 million monthly active users by January 2023, making it the fastest-growing consumer application in history.

ChatGPT represents a significant leap forward in the realm of conversational AI. This chatbot can engage users in natural and intelligent dialogue by leveraging its vast knowledge base and advanced algorithms. It's like having a virtual companion who can provide information, answer questions, and even engage in thought-provoking discussions. The potential applications for such technology are boundless, from personal assistance to customer support and beyond.

What makes ChatGPT particularly impressive is its large language model (LLM). This allows it to understand human language patterns and generate responses that sound remarkably authentic. Interacting with ChatGPT feels almost as if you're chatting with a real person, capable of understanding your queries and providing insightful answers. With each conversation, the chatbot continues to learn and improve, making future interactions even more seamless and satisfying.

The paragraphs above were written by artificial intelligence (Google’s Bard) with only a few prompts by me. This took less than a minute.

It’s simultaneously amazing and terrifying. Amazingly, I can generate this quality of output with only a few prompts. Terrifyingly, even on my best day, I could never produce something that cogent so quickly.

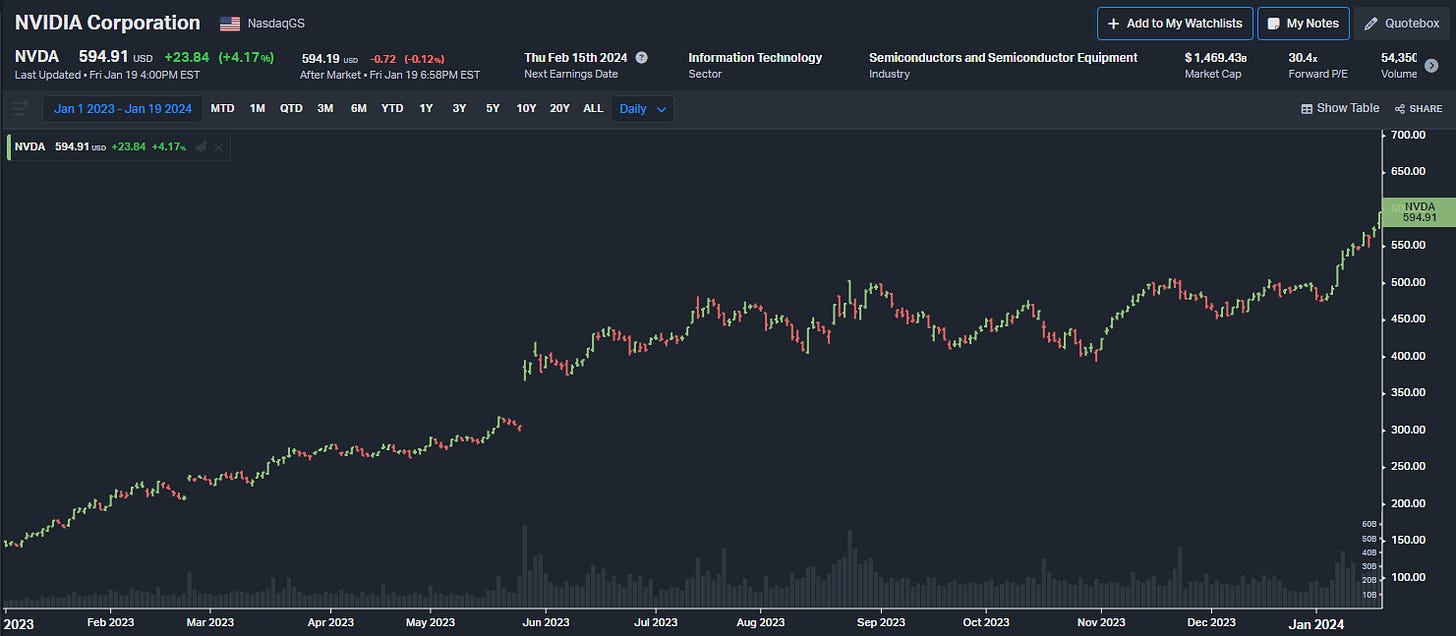

No wonder stocks like Nvidia (NVDA), which makes the chips - at $10,000 a pop, no less - that enable AI to do what it does, gained over 230% last year. And oh, by the way, it takes hundreds, not thousands, of chips to power AI programs. There are an estimated 14,700 AI startups in the US and 58,000 worldwide. That’s a lot of chips.

Microsoft, which has an equity stake in OpenAI and is incorporating Copilot AI into its software (Outlook, Powerpoint, Excel), is now the most valuable company in the US, overtaking Apple Inc., with a market capitalization of almost $3 trillion.

The artificial intelligence revolution is just getting started and is already boosting efficiency and changing the nature of work. AI can automate manual and repetitive tasks, freeing people to pursue more complex and creative pursuits. The real potential will be seen in the collaboration between humans and artificial intelligence.

AI could very well catalyze a second Roaring ‘20s, driving a burst of innovation and productivity. And we’re only in the early stages now.

Health and wellness get an unexpected boost: Five years ago, Novo Nordisk received approval from the Food and Drug Administration for a new drug to treat type-2 diabetes. This innovative drug, backed by rigorous clinical trials, offered patients a powerful tool to help regulate blood sugar, and its impact soon extended beyond initial expectations.

While effectively taming blood sugar was Ozempic's primary mission, clinical trials revealed that patients also lost weight. Studies showed that nearly half of participants shed 15% of their body weight within a year and a half. This finding ignited excitement, offering a potential weapon against America's obesity epidemic.

The seriousness of the situation is hard to ignore from an economic perspective. An estimated 42% of American adults, a staggering 110 million people, grapple with obesity. This translates to annual healthcare costs in the billions.

A new ray of hope has emerged with Wegovy, Novo Nordisk’s new, stronger version of Ozempic. Recent late-stage studies of Wegovy reveal a remarkable 20% reduction in heart attacks, strokes, and deaths from heart disease among patients. This finding opens doors to significantly improving the health and well-being of millions of Americans struggling with diabetes and obesity’s health risks. A wonderful development.

2023 saw the US economy defy predictions, shrugging off concerns about interest rate hikes. Financial safeguards put in place after past crises, combined with rapid liquidity support, prevented isolated bank issues from morphing into a broader meltdown. This year also witnessed the rise of two game-changing technologies - AI, poised to transform the way we work, and Wegovy, holding the potential to significantly improve our quality of life.

May these “most interesting things” be harbingers of hope and possibility for the year ahead.