It’s been quite a year.

The global coronavirus crisis and its effects on public health, economic activity, and public policy response dominated headlines once again this year. Every additional issue that’s taken investor mindshare in 2021 can trace its origin back to this.

Global equities: This was another strong year for global equity markets with the U.S. leading the way driven by strong corporate earnings - up 49 percent year-over-year for the S&P 500. Compared to 2020 when year-over-year earnings fell 14 percent, this earnings tailwind was the primary driver of market performance.

The S&P 500 led the way with a total return just shy of 30 percent, the technology heavy NASDAQ gained 27 percent, and both small and mid cap companies finished the year up over 25 percent.

International stocks were mixed with developed country equities positive by 12 percent while emerging market equities fell by 2 percent hampered by inflation, and a strong U.S. dollar.

Commodities and real estate lead the year returning in excess of 30 percent, the dollar finished the year higher 7 percent, with precious metals lower by 5 percent.

Interest rates: The yield on the benchmark 10-year U.S. treasury began the year at 0.91 percent rising to 1.52 percent at the end the year. The move higher in rates reflected a re-accelerating economy, the inflationary effects of policy decisions made to support Americans impacted by the Covid crisis.

The total return for the 10-year treasury was a negative 2.4 percent, which was the worst annual performance since 2013 when the 10-year lost more than 9 percent as the rate rose from 1.75 percent to 3 percent.

The real action, however, was in the front end of the yield curve as yields on the 2-, 3-, and 5-year treasury moved sharply higher as markets began to price in multiple rate hikes. The 2-year yield rose from 0.28 percent to 0.75 percent, the 3-year moved from 0.51 percent to 0.98, and the 5-year moved from 0.97 to 1.26 percent in the last quarter of 2021.

These were big moves driven by persistent inflation that prompted the Fed to pivot their attention to managing that part of their dual mandate.

Federal Reserve Policy: The extraordinary policies enacted at the beginning of the coronavirus crisis - interest rates held at the lower-bound (0-.25 percent) and asset purchases of $120 billion per month of treasuries and mortgage backed securities (quantitative easing) remain in place.

With the recent shift in Fed policy, the quantity of asset purchases has declined by half and are expected to end completely in the first quarter.

Futures markets are pricing in a greater than 70 percent probability that the first rate hike happens at the March 16 meeting. Odds are rising that at the May 4 meeting they hike again, bringing the Fed Funds rate to 0.50-0.75 percent.

What’s interesting is that by mid-year the odds of between two and three rate hikes currently have a greater than 70 percent probability and by year end there’s a better than 50 percent probability that the Fed hikes three to four times.

Global supply-chain: Manufacturing slowdowns in Asia were a direct result of policy response aiming to contain the spread of SARS-CoV-2 amid the Delta variant outbreak. Facilities were running well below capacity mid-year due to worker illness and intentional production slowdowns to help curb further transmission.

Backups at U.S. port facilities, shortage of truck drivers, and understaffed railways due to the Delta summer surge all contributed to clogging the logistics supply-chain here at home.

Inflation: The Consumer Price Index (CPI) recorded the highest year-over-year gain since June 1982, growing at 6.9 percent (4.9 percent excluding food and energy). The cost of living became more expensive last year as demand for goods overwhelmed the supply.

The U.S. consumer shifted spending from services (think travel, dining, entertainment) to goods (think furniture and bedding, major appliances, men’s and women’s apparel, new and used cars) during the pandemic. Because of policy support - enhanced unemployment insurance and one-time government payments - aggregate spending held steady at the same time manufacturing slowed.

High demand + constrained supply = inflation.

From the chart above, you can see that however regional Federal Reserve banks measure inflation, it’s moved from at or below target to solidly above target (red). The base case remains that manufacturing is picking up and supply-chain issues are getting resolved already in 2022 as the economy slowly returns to normalcy.

Employment: 2021 began with unemployment at 6.7 percent and as of the last reading in November, the official unemployment rate was 4.2 percent. In raw numbers, 3.8 million people found jobs last year, and December’s job gains haven’t yet been counted. Keep in mind that at the peak unemployment in the U.S. the unemployment rate stood at 14.8 percent in April 2020 with over 23 million unemployed.

The latest reading for initial unemployment claims released December 24 recorded 198,000, which is the lowest number since 1969. What makes this remarkable is that the population of the U.S. in 1969 was 202 million while today its 332 million. Truly a remarkable recovery.

According to the Bureau of Labor Statistics (BLS) there are currently over 11 million job openings in the U.S. and 6.9 million unemployed as employees continue to reevaluate their current work situations. Older employees are choosing early retirement, some are making career changes for better opportunities, and others are having to remain out of the workforce due to health or family considerations.

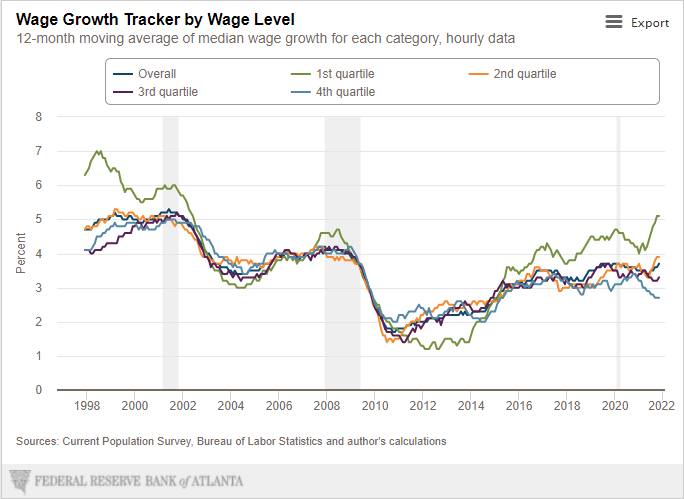

This labor supply mismatch has created an interesting dynamic with regard to wages - they’re moving higher. This is most noticeable for those in the first quartile - the lowest paid cohort - who bore the brunt of the Great Financial Crisis and were most impacted by Covid.

Covid remains the predominate global challenge entering 2022. Despite the recent surge of infections due to the Omicron variant, progress has been made. Over 9.3 billion doses have been administered across 184 countries, and here at home over 513 million shots have been given, with 73 percent of the population having had at least one dose.

The best case scenario is that this latest outbreak, which is much more transmissible but not as virulent as the Delta variant, combined with the tailwind of vaccinations, will help speed herd immunity. Only until we can put the Covid behind us will we be able to return to normal.

Stay tuned for the thematic issues that lay ahead for markets and the economy in 2022.